Our previously published Outset Data Pulse report concluded South Korea is a vital player in Asia’s crypto media industry.

This time, using fresher data from August to October, we examine what happened across the region as a whole at a time when the crypto market’s speculative frenzy cooled off and casual readers lost interest.

Summary

- Asia’s crypto media traffic fell nearly 15% from August to October as hype-driven readers exited, with direct traffic holding steady at around 54%.

- 81% of visits stayed concentrated among 20 trusted outlets, but readership loyalty remained fragmented by country, with no single regional hub.

- Publishers that retained audiences relied on established trust, ecosystem integrations, and emerging AI-driven discovery rather than speculative market interest.

Asia’s media ecosystem underwent a stress test, with overall traffic falling 14.51% from August through October. Our data reveal how trust and structure determine who restrained their audiences and who fell behind.

The crypto market’s bull run ended abruptly in early October, leading to a pullback in Asia’s online crypto readership. The logic here is that casual readers were only interested in following crypto’s rise and Bitcoin’s potential run to $150,000.

Our analysis concluded the decline in readership isn’t so much a panic signal. The summer hype brought in an influx of casual visitors, and when the hype subsided, those additional readers disappeared. The remaining audience consisted of investors and crypto natives who seek information even when prices are falling.

Key distinction from earlier this year

In Eastern Europe, 63% of crypto publishers lost traffic in Q2 as volatility created a more obvious winners-and-losers dynamics than Asia’s habit-driven activity.

This is evident from our finding that, even as total traffic declined, direct visits remained stable at approximately 54% of all crypto-native traffic. In Q2, we noted that more than half of Asian crypto readers used URLs, bookmarks, or apps to access their preferred news sites.

Encouragingly, the same trend was observed in South Korea, where readers consistently relied on known publications. As Outset PR’s senior analyst, Maximilian Fondé, previously stated,

“Asia’s crypto readership has entered a phase of maturity… Every direct visit reflects intent, not chance.”

Asia’s crypto audiences remain consolidated

Roughly 81% of all crypto news visits in August through October were concentrated in about 20 Asian outlets.

This is consistent with our prior Q2 finding of approximately 82%, indicating that readers continued to gravitate toward the same tier-1 publications that earned readers’ loyalty.

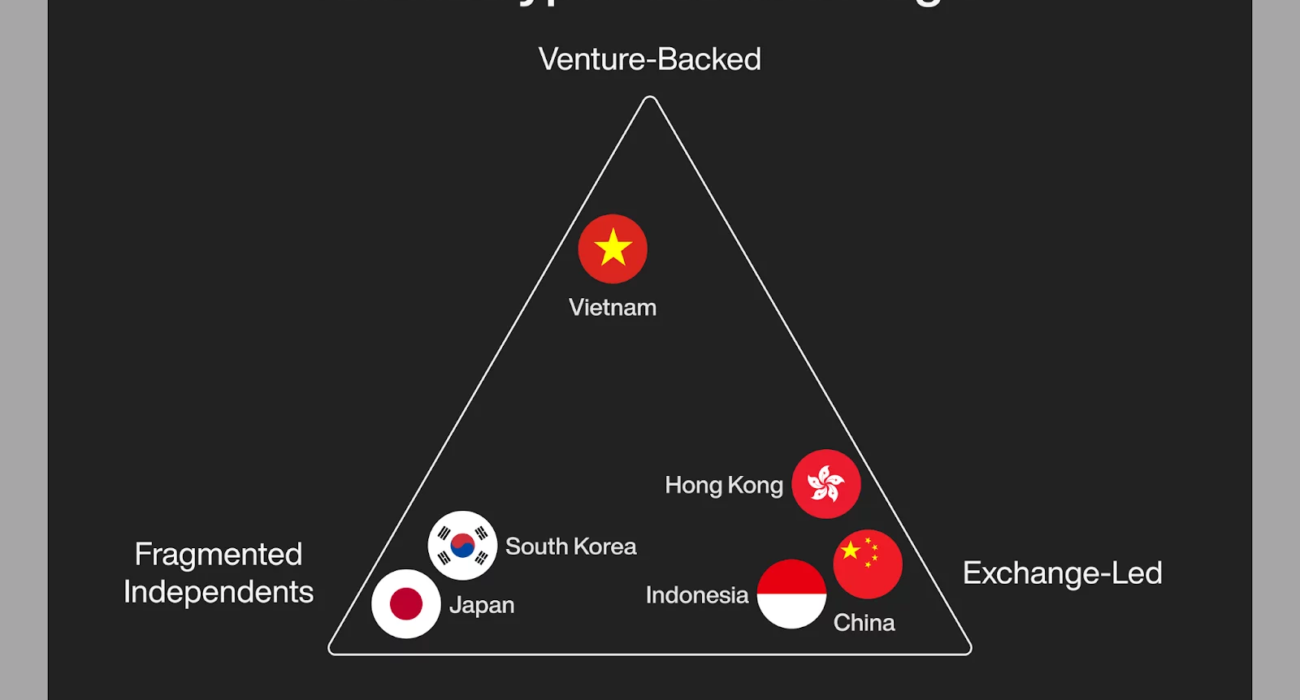

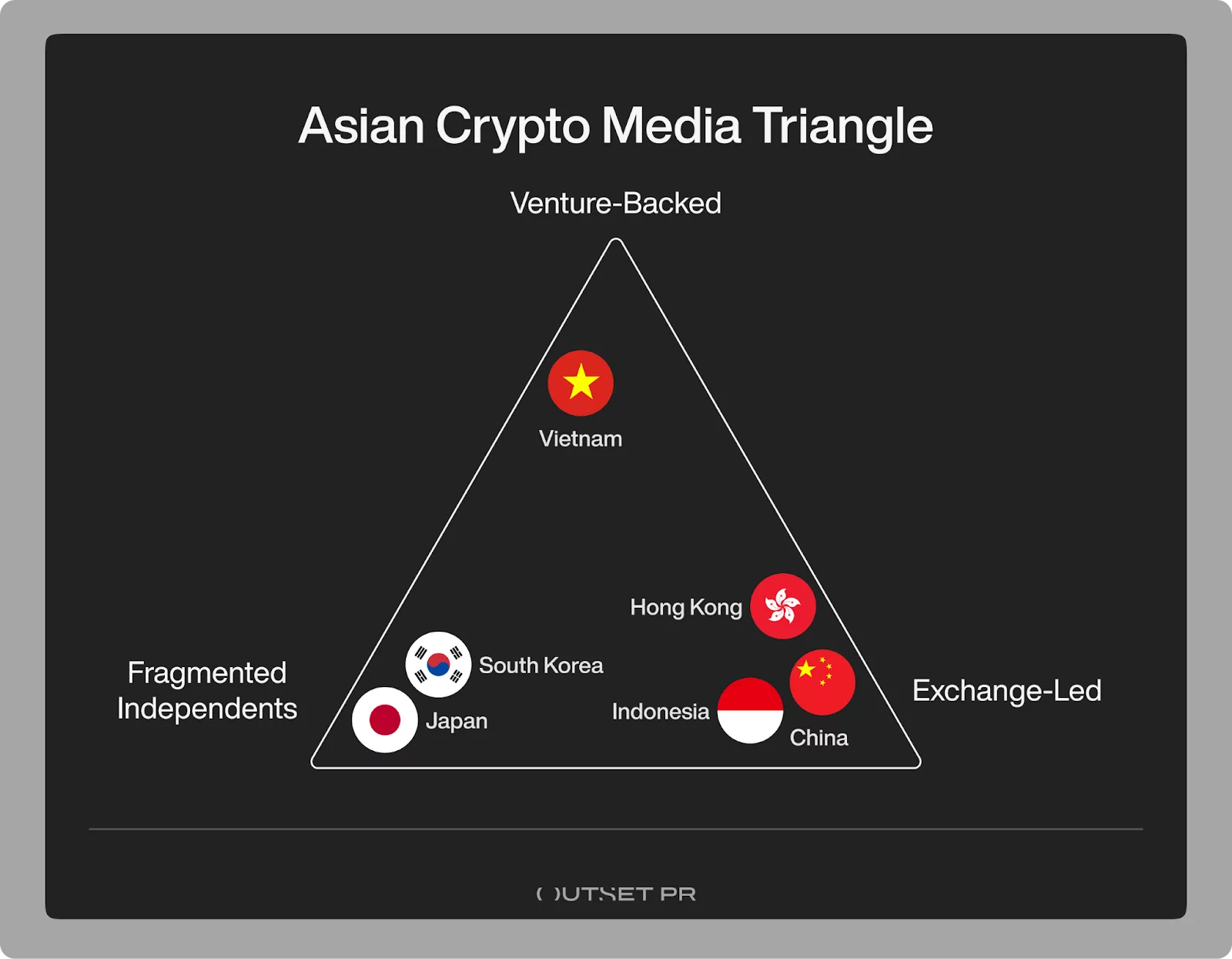

Asia: No single dominant crypto news source

In a separate report, we found there is no single “New York Times of crypto” that is widely regarded as the go-to platform. Rather, readers prioritized what they already trusted, market by market.

South Korean readers stuck with their native sites like CoinReaders or BlockMedia, while Japanese audiences leaned on domestic portals like CoinPost. In other countries, readership was constrained to outlets linked to exchanges or insiders. For example, Vietnamese readers expressed loyalty to local ventures like Kyros Ventures’ Coin68.

Essentially, trust remained constrained by borders and ecosystems, while no new breakthrough site emerged to attract a sufficiently large audience. If anything, this shows how fragmented Asia’s crypto media industry really is.

Does it matter if there is no single hub?

During the crypto downturn, we observed that a news story or outreach strategy that saw success in one Asian market didn’t automatically translate to another.

There is no one-stop portal to reach all of Asia’s crypto users. The previously mentioned 20 dominant outlets are distributed across the region, with a few sites operating in multiple languages.

Overall, Asian crypto news is split into three categories, including:

- venture-backed media groups

- exchange-linked networks

- independent regulated outlets

This does pose a challenge for a project or brand trying to get coverage in Asia as they must navigate multiple channels instead of relying on one marquee publication. It also explains why readers don’t have a single preference for any platform.

Consolidation in Asia is indeed very different from a region like Latin America where our data previously showed multiple countries’ audiences converging around one outlet. In Asia, consolidation occurs inward, not across borders, so cross-border loyalty is fragmented.

How Asian publishers adapt to a thin audience

A shrinking audience doesn’t necessarily mean publishers are doomed, although it does force adaptation. Publishers that established strong relationships with loyal readers who visited sites directly could rely on a 54.15% direct-traffic base to sustain their business. Brand loyalty and readership trust were viewed as a lifeline, as core readers continued to come, even as fewer casual readers showed interest.

Some outlets benefited from AI-driven discovery as an emerging traffic source. Between August and October, 11.49% of all Asian crypto news referrals came from AI. This means content surfaced via AI assistants, chatbots, or smart aggregators. This is a large jump from near-zero a year ago. We observed an early version of that shift in Western Europe, in which a visibility reset determined which publishers remained visible to readers as discovery became increasingly platform-mediated.

Well-structured content from reputable sites will be picked up by AI services and bring in readers who weren’t clicking traditional links at all.

We interpret this not necessarily as growth in the classic sense, but rather as an adoption mechanism. Publishers are formatting their articles and data in ways that are recognizable to AI algorithms. The successful outlets understood it is just as important to double down on human commentary to differentiate from AI-generated fluff.

Finally, many publishers leveraged their community and ecosystem integrations to expand their reach. For example, some exchange-linked news sections, such as Bithumb’s feed in Korea, enjoyed a captive audience among the exchange’s user base. When trends aren’t working in an outlet’s favor, the ability to tap into an active trading or social platform provides a steady flow of readers.

Looking beyond the hype: trust is what comes next

Post-hype data from Asia’s crypto media industry make it clear that when the speculative tide ends, observers can readily identify who the real audience trusts. The 14.5% traffic drop was not evenly distributed; it concentrated attention into the hands of a few dozen strong outlets.

Asia’s crypto media industry lacks a single center, which could be seen as a strength in some respects. Rather than a dramatic collapse, as seen in Latin America, Asia experienced a controlled consolidation. Essentially, the crypto conversation didn’t die; it contracted around its most trusted players.

For us at Outset PR, this outcome reinforces our opinion that trust can scale faster than traffic. When markets are hot, it is easy to get many clicks. But when markets cool, relationships and credibility retain, if not grow, in value. The Asia experience shows that this pattern holds across different markets. Readers will return to sources that proved reliable during the market frenzy.

As communicators and strategists, we take away a lesson in resilience. To reach Asia’s crypto audience, especially during bear markets, publishers must treat their relationship with readers as a long-term investment.

We will continue tracking these patterns in our Outset Data Pulse, but the takeaway is already clear: after the hype dies down, who’s left standing are outlets that could be trusted.