Marathon Digital Holdings, one of the largest publicly traded Bitcoin mining companies, has recently executed a significant on-chain movement of Bitcoin worth roughly $87 million amid a broader sell-off in crypto markets.

Summary

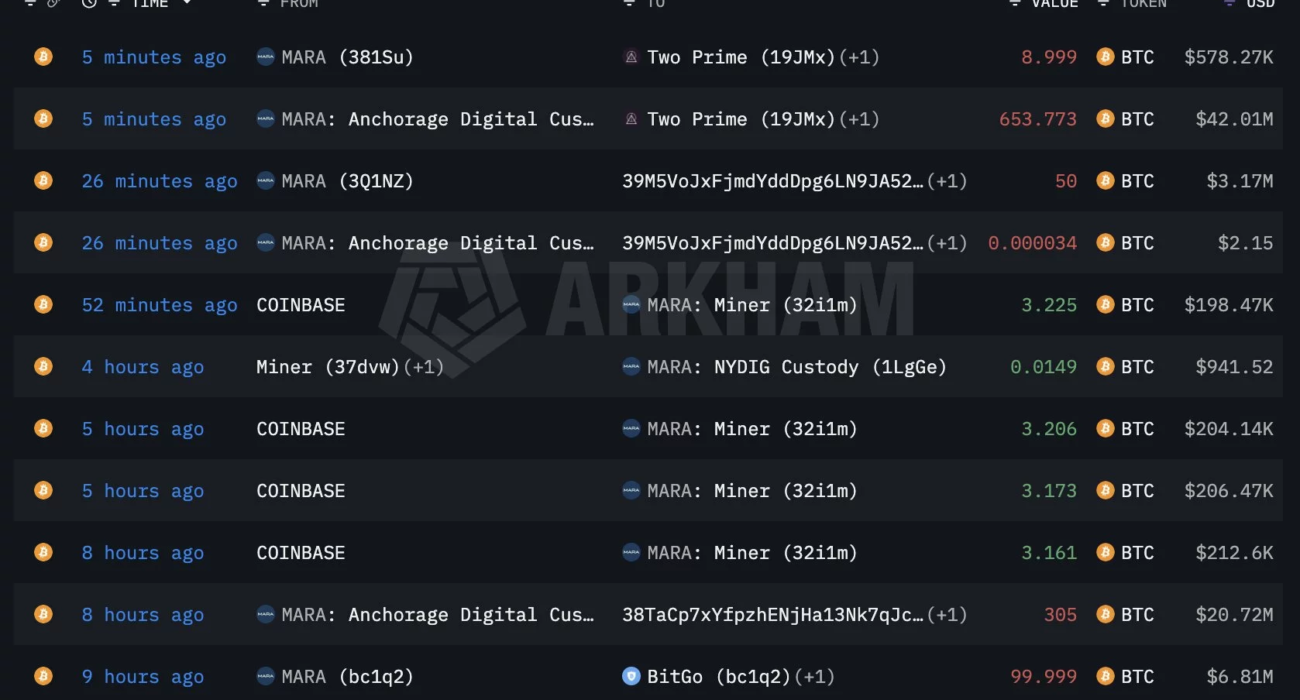

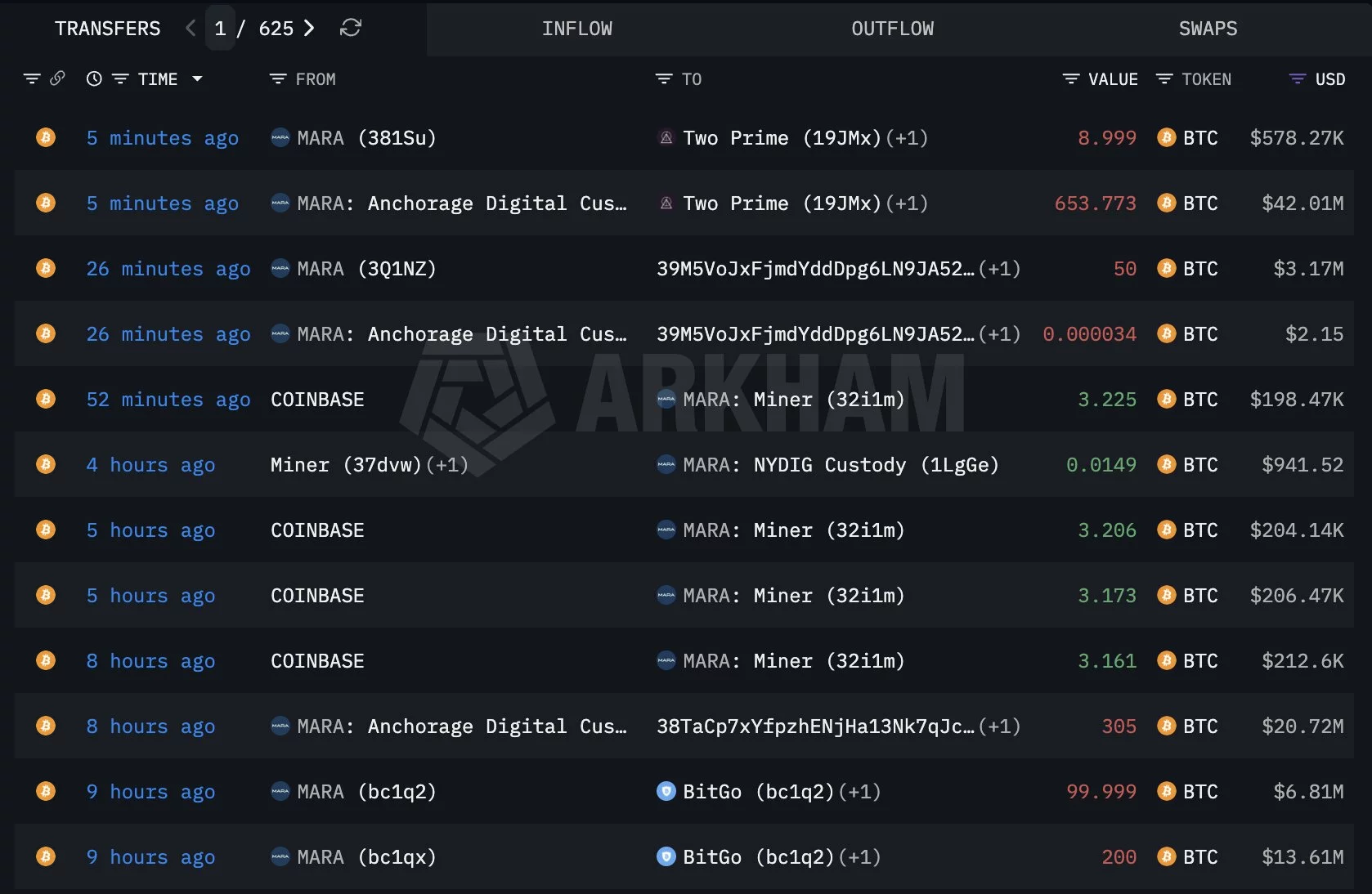

- Marathon Digital moved 1,318 BTC worth about $87 million over a 10-hour period, with funds sent to institutional counterparties, custodial wallets, and a newly created address, according to Arkham data.

- The transfers came amid a sharp pullback in Bitcoin prices, which briefly dipped toward $60,000, increasing pressure on bitcoin miners.

- The on-chain activity coincided with a nearly 19% drop in MARA shares in a single Nasdaq session, adding to investor unease across the mining sector.

The activity, captured by on-chain analytics firm Arkham, coincided with a sharp drop in Bitcoin’s (BTC) price and a steep decline in MARA’s stock.

Large BTC transfers spark market speculation

Over a roughly 10-hour period, Marathon Digital moved 1,318 BTC, valued at approximately $86.9 million at the time of transfer, from miner wallets to a mix of trading desks, custodial services, and other wallet addresses.

According to Arkham data, the largest transfer involved 653.773 BTC, worth about $42 million, sent to an address associated with institutional services provider Two Prime. Additional transfers included 200 BTC and 99.999 BTC to wallets linked to BitGo, totaling roughly $20.4 million.

Another 305 BTC, valued at about $20.7 million, was moved to a newly created wallet whose ownership remains unknown.

These on-chain moves drew attention because such large BTC movements during a market downturn are often interpreted as potential precursor actions to sales, hedging, or collateral posting.

The timing of the transfers came amid notable weakness in Bitcoin prices, which briefly dipped toward the $60,000 range before trading in the mid-$60,000s.

The on-chain activity also added to investor unease as Marathon Digital’s shares plunged. MARA stock fell nearly 19% in a single session on Nasdaq amid mounting pressure on bitcoin miners.

Though large transfers from miner wallets often trigger speculation, they don’t necessarily equate to immediate spot sales on exchanges. Institutional counterparties, lending arrangements, and collateralized trading strategies can all require BTC movements without marking direct liquidation.